Inflation stems from too much money chasing too few goods. U.S. consumer inflation is running at 9 percent as too much government‐spawned money creation is coinciding with restrictions on the supply side of the economy.

The “Inflation Reduction Act” in front of the Senate is supposed to address inflation by reducing budget deficits with a combination of tax hikes and green subsidies. But despite its name, the Senate bill would not reduce inflation because it would damage the supply side and hardly affect deficits.

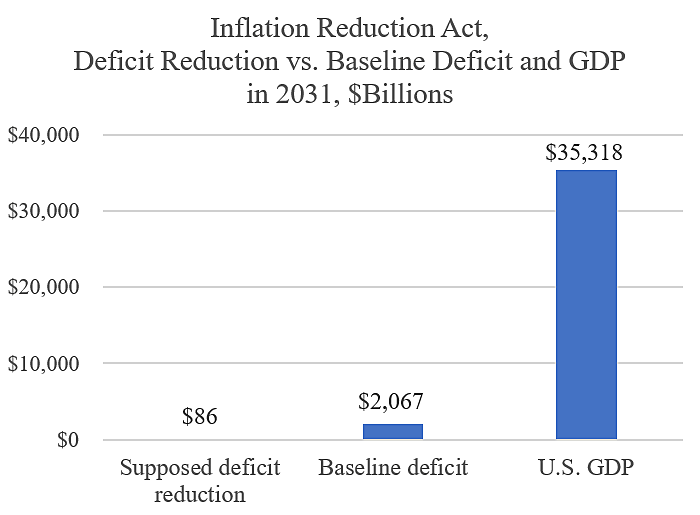

The budget modelers at Penn‐Wharton estimate that the Senate bill would reduce the deficit by $86 billion in 2031, at most. That would be just 4 percent of the projected deficit that year and just 0.2 percent of U.S. GDP. So the bill’s impact on inflation through reducing deficits and demand would be close to zero.

Tax Foundation calculates that the Senate bill would reduce deficits by $178 billion over 10 years, which is just 1 percent of expected deficits over the period. Both Tax Foundation and Penn‐Wharton find that the Senate bill would actually increase deficits the first few years, and thus have the opposite effect on inflation as the “reduction” promised by the bill’s title.

The figure below illustrates the Senate bill’s tiny impact even if it delivers what the sponsors promise. The reality is that the bill would likely increase deficits as new subsidies would beget more subsidies. Corporate lobbyists would push for subsidy expansion and other industries would demand similar handouts down the road.

And then there is the economy’s supply side. Raising taxes on corporations would reduce incentives to invest, and thus shrink production. The complexity of the proposed new minimum tax would exacerbate unproductive battles between the IRS and corporations. The Joint Committee on Taxation finds that half of the Senate tax hike would land on manufacturers. Money would be chasing fewer goods produced.

At the same time, the expansion of IRS enforcement unleashed by the Senate bill would cause huge headaches for small businesses and distract them from the marketplace. The IRS is a beast and jacking up its powers would be costly in terms of lost civil liberties.

Even if higher revenues generated by the Senate bill were devoted to deficit reduction, any benefits would not be worth the private‐sector damage. But most of the revenues would be gobbled up by new subsidies, and given DC’s political dynamics the subsidies would keep on growing and wipe out any budget benefits over time.

Themes: